The Economy According to JP Morgan

- Forward Thinking

- Feb 16, 2020

- 5 min read

As of writing this post on December 26, 2019, the US stock market has done extremely well and has beat record highs:

The NASDAQ and S&P500 has reached all-time highs as the the big indexes experience an end-of-the-year rally.

Based off the recent market highs, I decided to review some interesting graphs I found from JP Morgan's report that go over the economy and the financial markets.

Market Overvaluation

Unsurprisingly, returns in the market are low compared for companies with high P/E ratios.

The market might be overvalued (Find an article on it here) and a correction might be needed.

Firms are Focusing Less on Strategy

Yes, a portion of the EPS growth comes from revenue over the past few quarters. This is strategy, consisting of a set of activities done differently or better than the competition.

The majority of the EPS growth over the past few quarters has, however, been to improving margins. Something to note is operational effectiveness is NOT strategy. A little worrisome.

Executives Might Care More About Self-Interest

Healthcare is A Growing Industry, But Tough Times Might Be Ahead

The healthcare industry is a lucrative market right now with large returns.

This can be bound to change, however. Unicorns in the industry are being recognized as overvalued (Find an article on this here).

The Federal Reserve is Bringing Joy to the Markets

There is a correlation between changes in interest rates, when on the lower end, and positive returns in the market.

As the Federal Reserve, over the past few quarters, has lowered interest rates, the market has responded well.

Something to consider, however, is how far can this go? As an investor in the market, I should consider how rate changes will affect the overall economy rather than my holdings.

While a market correction is needed, the Federal Reserve is running out of ammunition to fight the next recession.

Consumer Finances are Stronger

Consumers, on average, have significantly greater assets than liabilities. Problem is that most of them are illiquid. After all, deposits are only 9% of total assets.

It's also very hopeful to see that debt-to-income ratios are decreasing.

These numbers, however, look at averages, which can be deceiving. Maybe a 60/40 ratio, which Ray Dalio suggests, would be more accurate.

Less Traditional Consumption Patterns

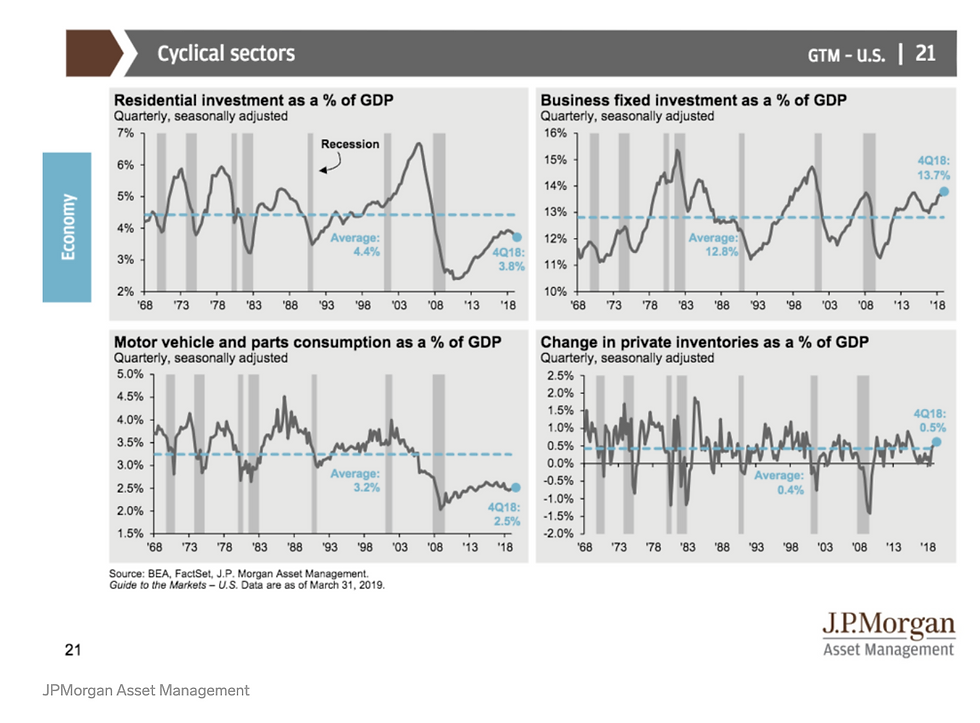

Residential investment and motor vehicle investments are down, which I do not find surprising at all.

This is not surprising as more millennials are entering the traditional period of life where they would make those investments. The problem: millennials have no money; so they can't invest in the cornerstones of 1) the American Dream and 2) the American economy (Find an article on it here).

Interested in learning what the future of the American economy will look like and where investments might grow instead.

Immigrants Matter for the Economy

Immigrants play a large part in growing the GDP. In simple terms, they boost the economy.

The growth in the working age population is forecasted to decrease substantially, especially for native-borns workers. So it is important that the US make up for that with immigrants.

President Trump has been a key proponent of changing immigration policy, from legal immigrants to asylum seekers. Even though there are fewer deportations under President Trump compared to those under President Obama, President Trump's rhetoric and policies have definitely deterred people from coming to the US. I am interested to see how the "deterrence" will affect the economy and future immigration trends.

Corporate Debt Might be the Next Bubble

Corporate debt issuance is at an all-time high and corporate debt ratings are sliding.

The question is will corporate debt be the next bust of the US economy?

Central Banks Are Running Out of Ammunition

Central banks purchased a large amount of bonds during the Great Recession. The Bank of Japan still holds onto quite a significant amount. It is predicted, by Ray Dalio, that purchasing bonds in the next recession will not have as much firepower.

Generally speaking, interest rates in the major economic blocks are low and have fueled economic development since the Great Recession. However, they can't be low forever. But raising interest rates can bring a slowdown, as well. Thus, it's a fine balancing act, but the question begs is where do interest rates go from here in the next recession (The ECB and BOJ both implemented negative rates with vague success).

Overall, the questions begs what is the next step for central bankers? Ray Dalio says maybe giving money directly to the people may be the next move (Find an article here).

Global Growth is Slowing Down

If one follows the news, it is no surprise that people are worried about the next recession. This graph shows the reasoning as global growth has slowed down.

The US is no surprise because of the trade war with China. The Eurozone is no surprise because of Brexit and because of certain member countries' economies not doing to well.

The question for me is what will cause the four markets to slow down together?

Trade is Slowing Down

Trade is slowing down globally. Brexit and the US's rewriting of trade deals definitely do not assist.

I find it interesting that China does not have the highest export-to-GDP ratio. It is actually Taiwan. It goes against the myth that China majorly depends on exports

The US's trade war with China might not as big as people make it to be. Yes, it is important. But, there is more trade with other markets, such as Europe.

Europe is Dependent on Itself

Europe's GDP and economy has become very dependent on domestic demand. It is visible that they are less dependent on exports.

The question I have is what will happen in Europe's next recession? How will they stimulate the economy, as exports can drive growth? Also, what is causing exports to become less important in the first place.

The Myth of China Depending on Exporting May Be Overstated

GDP growth in China surprisingly does not come from trade, which is a myth I believe many people hold. It is a sliver of GDP growth.

Most GDP growth comes from consumption and investment. I know that the Chinese government does prop up its economy though fiscal stimulus and investing, as seen by the number of bonds issued.

Emerging Markets Bring Opportunity

GDP growth in Emerging Markets has almost constantly been higher than that of Developed Markets.

The middle class is growing across the board in Emerging Markets. This will create more opportunity for their citizens through more economic growth and middle class consumer spending, which will further create economic growth.

Given the long-term opportunity, the Emerging Markets may be undervalued.

The Elderly Are Underprepared for Retirement

Some hopeful news it that life expectancy is improving across the board. This makes sense with better healthcare and diets.

However, with living longer, the elderly are not prepared for retirement. They tend to have significantly smaller amounts saved up compared to what they need. I wonder a few things. How will the difference be made up? How will not having enough saved affect life expectancy?

Investors Have a Bias

It is very interesting to see that investors allocate their capital based on what their specific geography is known for, in terms of industry.

I wonder what is the cause of this? For instance, do people in California have more efficient access to information somehow? Or, do people have a bias towards brands they know and connect with? Also, how does this affect valuations?

Hope these graphs and explanations shed some light onto the current state of the US economy and financial markets.

Sources:

Comments