JP Morgan: Partnering with the Non-Banks

- Forward Thinking

- Dec 13, 2019

- 5 min read

JP Morgan is considered one of the most influential and largest banks in the US, if not the world:

The bank is the largest bank in the US with over $2.7 trillion in assets. That’s a whole 12% of US GDP in 2018 (That’s massive)!

Jamie Dimon, the only pre-2008 recession banking CEO left, is considered to be the reason why JP Morgan is a top-tier bank. As such, Jamie Dimon is also considered to be the unofficial representative of the US banking industry.

JP Morgan, the founder of the bank, is credited with stopping the Panic of 1907; he was lauded by Wall Street as a savior. This made Washington realize the need for a backstop to the financial system, leading to the creation of the Federal Reserve. Crazy to think that a single man essentially saved the American economy and inspired the concept of central banking in the US.

It spun out Morgan Stanley from itself after Glass-Steagall was passed.

Watch how JP Morgan became what it is today below:

And even though JP Morgan is currently the largest bank in the US, Jamie Dimon and the incumbent firm understand that its position in the financial services industry is not set in stone. For the bank, competition lies in not only traditional banks but also in technology companies becoming non-bank financial companies.

"A [non-bank] financial institution (NBFI) is a financial institution that does not have a full banking license and cannot accept deposits from the public. However, NBFIs do facilitate alternative financial services, such as investment (both collective and individual), risk pooling, financial consulting, brokering, money transmission, and check cashing. NBFIs are a source of consumer credit (along with licensed banks)." - The World Bank

Currently, more and more non-banks are starting to pop-up, especially in the technology sector. Google wants to have checking accounts. Uber Money wants to be a bank for its drivers and maybe for riders, eventually. Apple has the new credit card. Facebook now has Facebook Pay, which is like Venmo. For all of the potential ventures, technology companies see non-banking as a method to reinvigorate their top and bottom lines.

Realistically, their desires to become non-banks are in the realm of possibility, especially if they learn how companies did it in China by using their proprietary technology rather than using partners. Doing so will provide technology companies different opportunities to further entrench customers in their business models, to save money on transactions fees, and hopefully create new revenues.

WeChat was originally used for social media and messaging, and now it is mobile payment arena.

Alibaba was originally for e-commerce, and now it has a banking arm called Ant Financial.

This trend of the growing non-bank sector is caused by a few reasons:

Non-banks are able to provide faster and more specialized products and services because they are leaner (Without physical locations for instance) and utilize technology (Such as machine learning and data analytics) more effectively.

Non-banks are able to reach the unbanked, underbanked (Small and medium businesses have about $5 trillion in lending needs that are not serviced by traditional banks), and credit invisible. They can provide cheaper and more convenient products and services than traditional banks.

Banks, such as JP Morgan, have responded by trying to become more like technology companies. This means circumventing the slow compliance division and truly innovating through investments in new systems, blockchain technology, artificial intelligence, or even creating an "alternative non-bank" through a traditional bank (Such as Marcus by Goldman Sachs; it offers savings accounts and lending without any brick and mortar stores).

And while banks have invested more in technology, the transition to non-banks by technology companies has not gone as smoothly. Many of them are starting to have negative public perceptions in regards to data, are facing potential anti-trust suits, and have experienced flat our rejection from regulators (Morgan Stanley stated that Facebook's Libra would compete with the Federal Reserve).

To get around this, banks and technology companies have strategically decided to cooperate rather than completely compete.

"The big tech firms get the consumer lock-in and business benefits they want, without the regulatory headaches." - Wired, Every Tech Company Wants to Be a Bank-Someday, At Least

And in openly cooperating with technology companies, JP Morgan has been able to further bolster one of its most important strategic principles: "First and foremost, we look at our business from the point of view of the customer." More specifically, JP Morgan has been able to focus more on the client's perspective by partnering with technology companies that desire to act more like non-banks.

Yes, JP Morgan has invested internally in the customer point of view:

It has invested over $20 billion to provide better and faster user experiences in legacy systems.

The bank rolled out You Invest, a free trading platform.

The mobile app. store has four major JP Morgan-related applications, with the lowest application rating being 4.5 / 5.0.

The investment in payments processing has allowed the firm to cut costs and boost efficiencies, making the process easier for customers and merchants.

At the same time, JP Morgan is also currently investing externally through partnerships that end up furthering the customer's point of view: it is helping create a more convenient and better experience for technology firms and their respective end-users, thus keeping the end-users with the technology firms' ecosystems.

"For JPMorgan, the path to survival involves ceding some control in order to build a moat around its global payments offering, a business that McKinsey & Co. has called 'the beachhead' of the entire banking relationship." - Bloomberg, JPMorgan Has a Plan to Help Amazon and AirBnb Look More Like Banks

The deals tend to create a symbiotic relationship. JP Morgan assists in creating virtual bank accounts, which then assists technology companies in spending less on third-party payment processing fees. The hope is that, for a discounted price, JP Morgan can simplify an e-commerce company’s refund process, expedite payouts to sellers, and boost loyalty. However, the caveat is that the technology firms then have to use JP Morgan for all payment processing and cash movement activities.

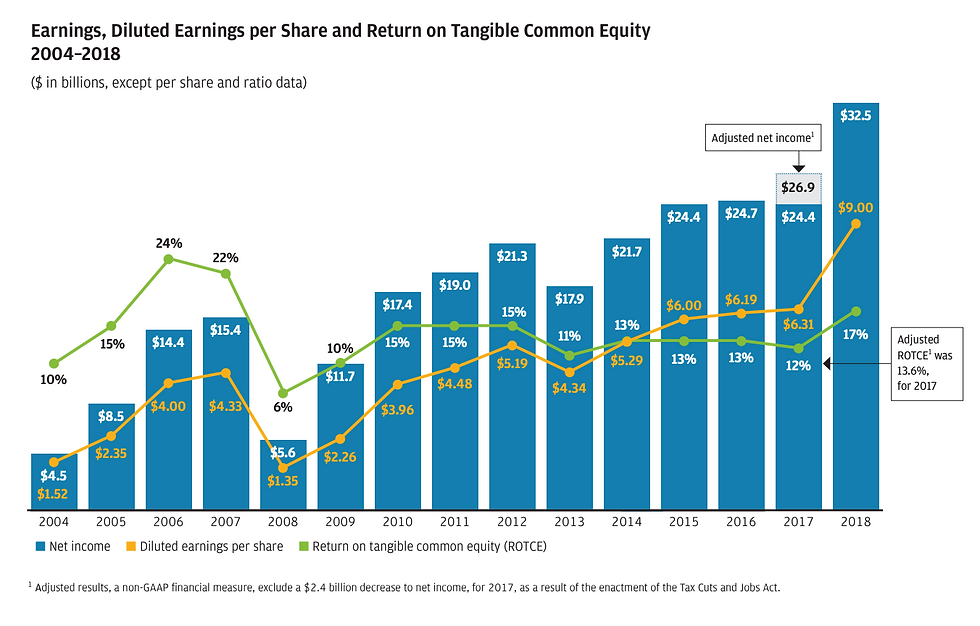

And in following the strategic principle of the customer point of view through partnerships with technology firms, JP Morgan has been able to do well. Below are different metrics about profitability, the balance sheet, share price, and customer growth:

So, what's the so what from JP Morgan?

Competition comes from non-traditional areas, even places one would never consider. Remember, you don't know what you don't know.

Focus on the customer experience and make it better, something Jeff Bezos would 100% agree on.

Create new products and services to get ahead and control the industry before it takes off by strategically partnering others.

If you have time, I also suggest watching Jamie Dimon's explanation of JP Morgan's global strategy:

Comments