Ray Dalio: The Effects of Debt and Low Interest Rates

- Forward Thinking

- Nov 18, 2019

- 4 min read

Recently, Ray Dalio (Founder, Co-Chief Investment Officer, and Co-Chairman of Bridgewater Associates) posted The World Has Gone Mad and the System is Broken. It analyzes the the problem of debt and interest rates in the world of investing, wealth inequalities, and the labor market. I summarized his points below:

"Money is free for those who are creditworthy because the investors who are giving it to them are willing to get back less than they give."

Money, for the creditworthy, is being pushed onto institutions by central banks. Instead of pushing for more economic growth and inflation (Which is caused by actual spending), institutional investors are instead driving up the prices of equities and bonds (Which return low or negative interest rates) while making future expected returns disappear.

As an investor myself, and like thousands of other Americans, this is an area of worry because this means that there is an overvaluation of the market. And with overvaluation comes an eventual, sometimes very harsh, correction, which can really hurt investment portfolios.

"This whole dynamic [of large government debts] in which sound finance is being thrown out the window will continue and probably accelerate, especially in the reserve currency countries and their currencies."

Large government debts are predicted to increase. They will be able to pay their debts (Principal and interest) by issuing more debt.

The newly issued government debt, which will be of a substantial amount, will be pushed into the markets which can't absorb it. This would in turn drive up interest rates and hurt the markets.

Higher interest rates hurts consumers, like me and you, in many forms: credit cards, car payments, and mortgage payments.

"Pension and healthcare liability payments will increasingly be coming due while many of those who are obligated to pay them don’t have enough money to meet their obligations."

Pensions are modeled after assumed returns higher (By around 7%) than market returns. Thus, come time to pay them back, the pensions won't have enough money to pay their obligations.

A method to relieve this issue (Excluding cutting benefits and raising taxes) includes printing money (Which if done in a country's denomination, the debtors only have to deliver the money). This will create a wealth transfer by making asset prices rise and then worsen the wealth gap.

The worsening wealth gap will create a battle between the rich and the poor over how to fund the obligations.

In addition, printing more money will threaten the viability of major world reserve currencies.

From the perspective of an American, more wealth inequality is not what America needs. It will hurt more people and will tear this nation apart even more.

"[Money] is essentially unavailable to those who don’t have money and creditworthiness... Because the “trickle-down” process of... improving their earnings and creditworthiness is not working, the system of making capitalism work well for most people is broken."

This leads to increasing wealth and political gaps.

Also, investors are investing in technology that will replace human labor, which leaves behind workers since they will not be retrained.

Having read Ray Dalio's view on debt and interest rates in investing, wealth inequality, and the labor market, I began to think about the effects of low interest rates and increasing debts in the private sector.

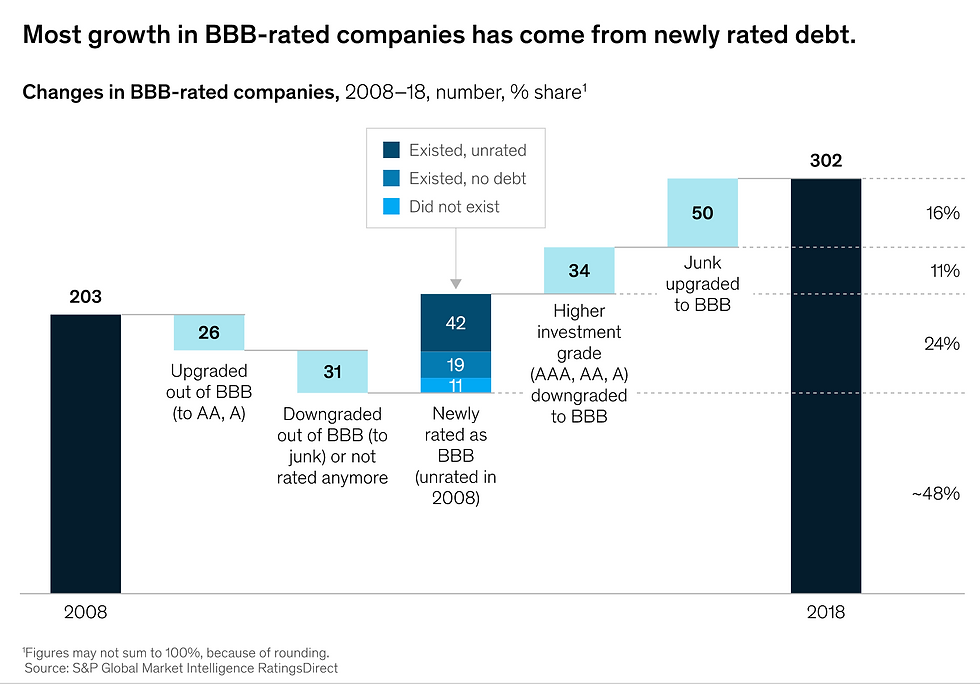

Because of historically low interest rates, companies have decided to take on more debt to finance their growth; from 2008 - 2018, corporate debt has more than doubled to $5.2 trillion. During the same time period, the amount of sub-investment grade quality companies generally increased, as well. However, analyses show that it is not because of the growth in corporate debt, as a whole, or in downgrades from credit-rating agencies but rather from changes in corporate debt ratings.

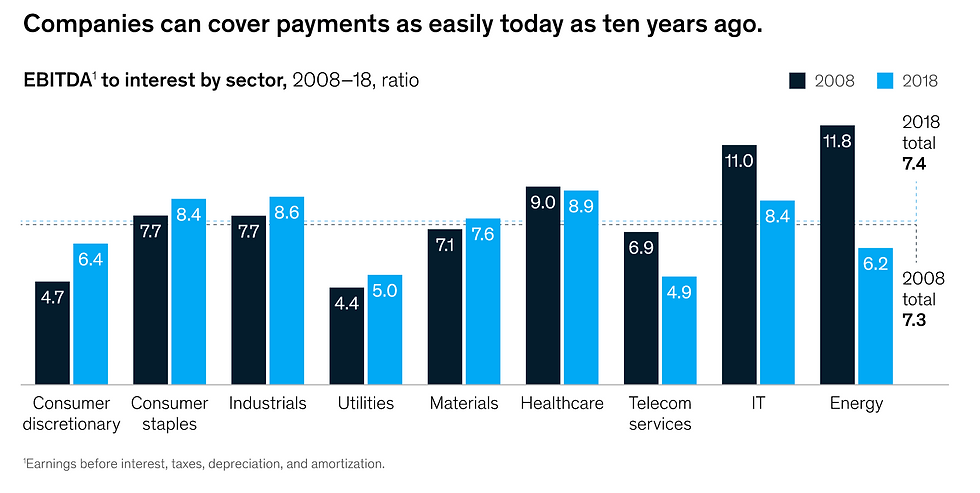

In addition, it seems that corporations are generally able to cover their interest payments.

So overall it looks like companies can cover their obligations, for now. This does not mean, however, this will always be the case. What happens if tough economic times or high interest rates come along? Analyses also show, in the short - term, companies will be fine.

"We estimate that about 75 to 80 percent of total corporate debt is in the form of corporate bonds, which tend to be fixed-rate investments. These are not typically affected by interest-rate changes until refinancing, and our estimates suggest that fewer than 35 percent of outstanding corporate bonds will need to be refinanced within three years. Overall, about 40 to 45 percent of the total outstanding corporate debt could be affected by higher interest rates by 2020 (if they come)." - McKinsey & Co., Is leverage reckoning coming?

Nonetheless, companies and their leadership should be willing to stress-test their companies to readjust their capital structures that make sense for them.

So what's the so what of all this?

Debt and low interest rates can be good and bad.

Investors and asset managers need to be aware of overvaluations caused by excess cash and, as a result, need to include this knowledge into models and should be looking more carefully for undervalued opportunities; maybe holding cash rather than spending it isn't such a bad thing (Berkshire Hathaway has $122 billion in cash after all).

Governments needs to be more aware and take more action to both run surpluses and reduce debts. If anything, they need to think about capital structures and better methods of paying off obligations.

Governments and societies need to be aware of the negative effects easy access to capital, for those who are credit-worthy, have on wealth inequality. They need to be thinking about how to improve opportunities for creating wealth for those who have more difficulty accessing capital.

There needs to be retraining programs for low-skill laborers as automation grows.

Companies, even with the growth in corporate debt, are generally fine in regards to credit ratings and ability to pay obligations. However, leadership need to be constantly stress-testing their company's capital structure for interest rate changes and economic downturns and need to adjust their capital structure appropriately.

Comments